Marsh & McLennan Companies, Inc. (NYSE:MMC) has received an average recommendation of “Hold” from the eleven brokerages that are currently covering the firm, Marketbeat reports. One investment analyst has rated the stock with a sell rating, five have given a hold rating and five have assigned a buy rating to the company. The average twelve-month target price among brokerages that have updated their coverage on the stock in the last year is $91.86.

Marsh & McLennan Companies, Inc. (NYSE:MMC) has received an average recommendation of “Hold” from the eleven brokerages that are currently covering the firm, Marketbeat reports. One investment analyst has rated the stock with a sell rating, five have given a hold rating and five have assigned a buy rating to the company. The average twelve-month target price among brokerages that have updated their coverage on the stock in the last year is $91.86.

A number of research analysts have commented on the company. Citigroup boosted their target price on Marsh & McLennan Companies from $94.00 to $97.00 and gave the company a “buy” rating in a research note on Thursday, July 12th. Zacks Investment Research downgraded Marsh & McLennan Companies from a “buy” rating to a “hold” rating in a research note on Wednesday, April 4th.

Get Marsh & McLennan Companies alerts:Several institutional investors and hedge funds have recently added to or reduced their stakes in MMC. Artisan Partners Limited Partnership lifted its position in shares of Marsh & McLennan Companies by 3.8% during the 1st quarter. Artisan Partners Limited Partnership now owns 7,851,174 shares of the financial services provider’s stock worth $648,428,000 after purchasing an additional 287,978 shares during the last quarter. JPMorgan Chase & Co. lifted its position in shares of Marsh & McLennan Companies by 22.5% during the 1st quarter. JPMorgan Chase & Co. now owns 5,322,464 shares of the financial services provider’s stock worth $439,582,000 after purchasing an additional 976,003 shares during the last quarter. OppenheimerFunds Inc. lifted its position in shares of Marsh & McLennan Companies by 10.5% during the 1st quarter. OppenheimerFunds Inc. now owns 3,609,298 shares of the financial services provider’s stock worth $298,093,000 after purchasing an additional 342,211 shares during the last quarter. American Century Companies Inc. lifted its position in shares of Marsh & McLennan Companies by 155.0% during the 1st quarter. American Century Companies Inc. now owns 2,822,249 shares of the financial services provider’s stock worth $233,090,000 after purchasing an additional 1,715,497 shares during the last quarter. Finally, Mawer Investment Management Ltd. lifted its position in shares of Marsh & McLennan Companies by 1.2% during the 1st quarter. Mawer Investment Management Ltd. now owns 2,810,468 shares of the financial services provider’s stock worth $232,071,000 after purchasing an additional 32,203 shares during the last quarter. Institutional investors own 85.06% of the company’s stock.

NYSE MMC traded up $0.35 on Friday, reaching $87.48. The stock had a trading volume of 1,357,426 shares, compared to its average volume of 1,817,835. The company has a debt-to-equity ratio of 0.72, a current ratio of 1.52 and a quick ratio of 1.52. Marsh & McLennan Companies has a 1 year low of $76.68 and a 1 year high of $87.89. The company has a market capitalization of $44.21 billion, a P/E ratio of 22.32, a price-to-earnings-growth ratio of 1.61 and a beta of 0.96.

Marsh & McLennan Companies (NYSE:MMC) last issued its earnings results on Thursday, April 26th. The financial services provider reported $1.38 EPS for the quarter, beating analysts’ consensus estimates of $1.30 by $0.08. Marsh & McLennan Companies had a return on equity of 29.38% and a net margin of 11.11%. The firm had revenue of $4 billion for the quarter, compared to the consensus estimate of $3.87 billion. During the same quarter in the previous year, the company posted $1.08 earnings per share. The business’s quarterly revenue was up 14.2% compared to the same quarter last year. equities analysts anticipate that Marsh & McLennan Companies will post 4.33 EPS for the current year.

The business also recently declared a quarterly dividend, which will be paid on Wednesday, August 15th. Stockholders of record on Wednesday, July 11th will be paid a dividend of $0.415 per share. This represents a $1.66 annualized dividend and a dividend yield of 1.90%. The ex-dividend date is Tuesday, July 10th. This is an increase from Marsh & McLennan Companies’s previous quarterly dividend of $0.38. Marsh & McLennan Companies’s dividend payout ratio is 42.35%.

Marsh & McLennan Companies Company Profile

Marsh & McLennan Companies, Inc, a professional services firm, provides advice and solutions in the areas of risk, strategy, and people worldwide. It operates in two segments, Risk and Insurance Services, and Consulting. The Risk and Insurance Services segment offers risk management services, such as risk advice, risk transfer, and risk control and mitigation solutions, as well as insurance, reinsurance broking, catastrophe and financial modeling, and related advisory services.

Featured Story: Relative Strength Index

Version (CURRENCY:V) traded 4.8% lower against the dollar during the 1 day period ending at 15:00 PM Eastern on July 19th. Version has a total market cap of $1.17 million and approximately $47.00 worth of Version was traded on exchanges in the last day. In the last seven days, Version has traded up 17.9% against the dollar. One Version coin can now be bought for about $0.0023 or 0.00000031 BTC on popular exchanges including Cryptopia and YoBit.

Version (CURRENCY:V) traded 4.8% lower against the dollar during the 1 day period ending at 15:00 PM Eastern on July 19th. Version has a total market cap of $1.17 million and approximately $47.00 worth of Version was traded on exchanges in the last day. In the last seven days, Version has traded up 17.9% against the dollar. One Version coin can now be bought for about $0.0023 or 0.00000031 BTC on popular exchanges including Cryptopia and YoBit.  Equities research analysts expect World Fuel Services Corp (NYSE:INT) to report sales of $9.35 billion for the current quarter, Zacks reports. Two analysts have issued estimates for World Fuel Services’ earnings, with estimates ranging from $9.01 billion to $9.69 billion. World Fuel Services posted sales of $8.09 billion during the same quarter last year, which suggests a positive year-over-year growth rate of 15.6%. The company is scheduled to issue its next earnings report on Thursday, July 26th.

Equities research analysts expect World Fuel Services Corp (NYSE:INT) to report sales of $9.35 billion for the current quarter, Zacks reports. Two analysts have issued estimates for World Fuel Services’ earnings, with estimates ranging from $9.01 billion to $9.69 billion. World Fuel Services posted sales of $8.09 billion during the same quarter last year, which suggests a positive year-over-year growth rate of 15.6%. The company is scheduled to issue its next earnings report on Thursday, July 26th. WhatsApp is fighting fake rumors on its platform through full-page ads in major Indian newspapers.

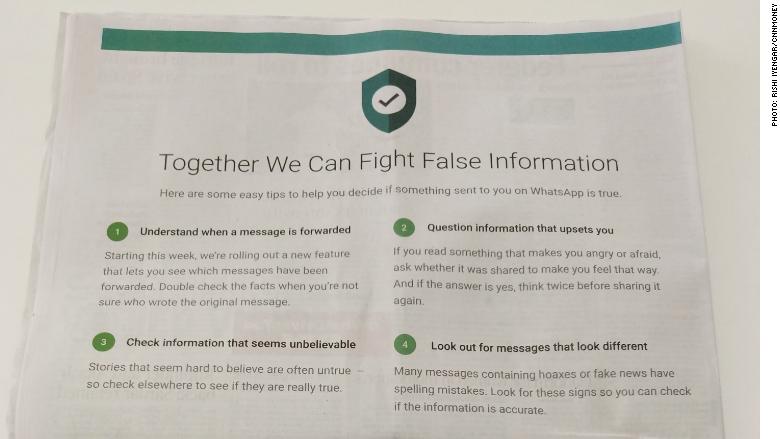

WhatsApp is fighting fake rumors on its platform through full-page ads in major Indian newspapers.