As Snap Inc. approaches its initial public offering, one question on investors�� minds is whether the parent of the Snapchat social app will be the next Facebook (FB) or the next Twitter (TWTR). Shares of the two established social media companies have taken divergent paths since being offered to the public.

See Also: 25 Dividend Stocks You Can Buy and Hold ForeverBear in mind that it's risky to make an investment in the early days of an IPO. Kiplinger's advice with any public offering is to wait at least 90 days before buying in. That allows enough time for the hype to die down and rational analysis of a company��s business prospects to take over.

Snap certainly has a lot of hype surrounding it, and early analysis of its business prospects reveals risks.

Hot Stocks To Own For 2019: Cidara Therapeutics, Inc.(CDTX)

Advisors' Opinion:- [By Chris Lange]

Cidara Therapeutics Inc. (NASDAQ: CDTX) shares took a big step back on Monday, despite the firm reporting positive midstage results. Specifically, Cidara reported positive topline results from its Phase 2 Strive clinical trial of its lead antifungal candidate rezafungin acetate.

- [By Max Byerly]

Get a free copy of the Zacks research report on Cidara Therapeutics (CDTX)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

- [By Stephan Byrd]

These are some of the media headlines that may have impacted Accern Sentiment’s analysis:

Get Cidara Therapeutics alerts: Cidara Therapeutics (CDTX) Upgraded to Buy at WBB Securities (americanbankingnews.com) Data to be Presented at ASM Microbe 2018 Demonstrate the Efficacy and Safety of Cidara��s Rezafungin for the Treatment of Invasive Fungal Infections (finance.yahoo.com) Cidara Therapeutics and Rutgers University awarded $5.5M grant from NIH to develop immunotherapy agents targeting gram-negative bacterial infections (seekingalpha.com) Cidara Therapeutics Announces Offering of Common Stock and Warrants (finance.yahoo.com) Cidara Therapeutics and Rutgers University Awarded $5.5 Million Grant from NIH to Support Development of Novel Immunotherapy Agents Targeting Multi-drug Resistant Gram-negative Bacterial Infections (finance.yahoo.com)Shares of CDTX stock traded up $0.30 during trading on Wednesday, hitting $5.20. 311,700 shares of the company were exchanged, compared to its average volume of 203,168. The company has a debt-to-equity ratio of 0.15, a quick ratio of 5.99 and a current ratio of 5.99. The stock has a market cap of $97.33 million, a P/E ratio of -1.64 and a beta of 2.05. Cidara Therapeutics has a twelve month low of $3.70 and a twelve month high of $8.80.

- [By Joseph Griffin]

Cidara Therapeutics (NASDAQ:CDTX) issued its quarterly earnings data on Thursday. The biotechnology company reported ($0.80) earnings per share (EPS) for the quarter, missing the Zacks’ consensus estimate of ($0.70) by ($0.10), Bloomberg Earnings reports.

Hot Stocks To Own For 2019: Haverty Furniture Companies, Inc.(HVT)

Advisors' Opinion:- [By Joseph Griffin]

Get a free copy of the Zacks research report on Havertys (HVT)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

- [By Ethan Ryder]

Havertys (NYSE:HVT) – Stock analysts at KeyCorp dropped their Q2 2018 earnings per share estimates for Havertys in a research report issued on Wednesday, May 2nd. KeyCorp analyst B. Thomas now anticipates that the company will post earnings per share of $0.29 for the quarter, down from their previous forecast of $0.31. KeyCorp also issued estimates for Havertys’ Q3 2018 earnings at $0.39 EPS and Q4 2018 earnings at $0.45 EPS.

- [By Ethan Ryder]

Get a free copy of the Zacks research report on Havertys (HVT)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

Hot Stocks To Own For 2019: Integrated Electrical Services Inc.(IESC)

Advisors' Opinion:- [By Shane Hupp]

Gendell Jeffrey L decreased its stake in shares of IES Holdings Inc (NASDAQ:IESC) by 0.3% during the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 12,319,064 shares of the technology company’s stock after selling 36,081 shares during the period. IES comprises 21.0% of Gendell Jeffrey L’s portfolio, making the stock its largest holding. Gendell Jeffrey L owned about 0.58% of IES worth $186,634,000 as of its most recent filing with the Securities & Exchange Commission.

Hot Stocks To Own For 2019: The Gabelli Healthcare & Wellness Trust(GRX)

Advisors' Opinion:- [By Shane Hupp]

GOLD Reward Token (CURRENCY:GRX) traded 2% higher against the US dollar during the twenty-four hour period ending at 12:00 PM ET on July 22nd. GOLD Reward Token has a market capitalization of $0.00 and $0.00 worth of GOLD Reward Token was traded on exchanges in the last 24 hours. One GOLD Reward Token token can now be bought for about $0.0041 or 0.00000055 BTC on cryptocurrency exchanges including Livecoin and CoinExchange. Over the last week, GOLD Reward Token has traded down 10.8% against the US dollar.

- [By Stephan Byrd]

GOLD Reward Token (CURRENCY:GRX) traded flat against the US dollar during the 24-hour period ending at 23:00 PM ET on June 25th. In the last seven days, GOLD Reward Token has traded 2.6% lower against the US dollar. One GOLD Reward Token token can now be bought for approximately $0.0050 or 0.00000080 BTC on popular cryptocurrency exchanges including Livecoin and CoinExchange. GOLD Reward Token has a market cap of $0.00 and $3.00 worth of GOLD Reward Token was traded on exchanges in the last 24 hours.

- [By Stephan Byrd]

GOLD Reward Token (CURRENCY:GRX) traded down 3% against the U.S. dollar during the 1 day period ending at 13:00 PM ET on July 1st. During the last week, GOLD Reward Token has traded flat against the U.S. dollar. One GOLD Reward Token token can currently be purchased for $0.0044 or 0.00000070 BTC on popular exchanges including CoinExchange and Livecoin. GOLD Reward Token has a total market capitalization of $0.00 and approximately $1.00 worth of GOLD Reward Token was traded on exchanges in the last 24 hours.

Marsh & McLennan Companies, Inc. (NYSE:MMC) has received an average recommendation of “Hold” from the eleven brokerages that are currently covering the firm, Marketbeat reports. One investment analyst has rated the stock with a sell rating, five have given a hold rating and five have assigned a buy rating to the company. The average twelve-month target price among brokerages that have updated their coverage on the stock in the last year is $91.86.

Marsh & McLennan Companies, Inc. (NYSE:MMC) has received an average recommendation of “Hold” from the eleven brokerages that are currently covering the firm, Marketbeat reports. One investment analyst has rated the stock with a sell rating, five have given a hold rating and five have assigned a buy rating to the company. The average twelve-month target price among brokerages that have updated their coverage on the stock in the last year is $91.86.  Version (CURRENCY:V) traded 4.8% lower against the dollar during the 1 day period ending at 15:00 PM Eastern on July 19th. Version has a total market cap of $1.17 million and approximately $47.00 worth of Version was traded on exchanges in the last day. In the last seven days, Version has traded up 17.9% against the dollar. One Version coin can now be bought for about $0.0023 or 0.00000031 BTC on popular exchanges including Cryptopia and YoBit.

Version (CURRENCY:V) traded 4.8% lower against the dollar during the 1 day period ending at 15:00 PM Eastern on July 19th. Version has a total market cap of $1.17 million and approximately $47.00 worth of Version was traded on exchanges in the last day. In the last seven days, Version has traded up 17.9% against the dollar. One Version coin can now be bought for about $0.0023 or 0.00000031 BTC on popular exchanges including Cryptopia and YoBit.  Equities research analysts expect World Fuel Services Corp (NYSE:INT) to report sales of $9.35 billion for the current quarter, Zacks reports. Two analysts have issued estimates for World Fuel Services’ earnings, with estimates ranging from $9.01 billion to $9.69 billion. World Fuel Services posted sales of $8.09 billion during the same quarter last year, which suggests a positive year-over-year growth rate of 15.6%. The company is scheduled to issue its next earnings report on Thursday, July 26th.

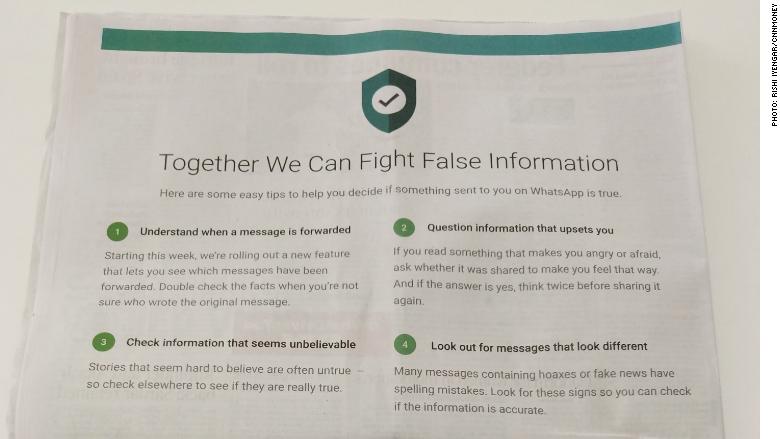

Equities research analysts expect World Fuel Services Corp (NYSE:INT) to report sales of $9.35 billion for the current quarter, Zacks reports. Two analysts have issued estimates for World Fuel Services’ earnings, with estimates ranging from $9.01 billion to $9.69 billion. World Fuel Services posted sales of $8.09 billion during the same quarter last year, which suggests a positive year-over-year growth rate of 15.6%. The company is scheduled to issue its next earnings report on Thursday, July 26th. WhatsApp is fighting fake rumors on its platform through full-page ads in major Indian newspapers.

WhatsApp is fighting fake rumors on its platform through full-page ads in major Indian newspapers.

NantHealth (NASDAQ:NH) has been given a consensus rating of “Buy” by the six research firms that are presently covering the stock, Marketbeat Ratings reports. One investment analyst has rated the stock with a hold recommendation and five have issued a buy recommendation on the company. The average twelve-month target price among analysts that have issued a report on the stock in the last year is $4.69.

NantHealth (NASDAQ:NH) has been given a consensus rating of “Buy” by the six research firms that are presently covering the stock, Marketbeat Ratings reports. One investment analyst has rated the stock with a hold recommendation and five have issued a buy recommendation on the company. The average twelve-month target price among analysts that have issued a report on the stock in the last year is $4.69.  Equities research analysts expect Health Insurance Innovations (NASDAQ:HIIQ) to announce sales of $69.14 million for the current fiscal quarter, Zacks reports. Three analysts have issued estimates for Health Insurance Innovations’ earnings. The lowest sales estimate is $66.50 million and the highest is $71.10 million. Health Insurance Innovations reported sales of $61.78 million in the same quarter last year, which would suggest a positive year over year growth rate of 11.9%. The company is expected to announce its next quarterly earnings report on Wednesday, August 1st.

Equities research analysts expect Health Insurance Innovations (NASDAQ:HIIQ) to announce sales of $69.14 million for the current fiscal quarter, Zacks reports. Three analysts have issued estimates for Health Insurance Innovations’ earnings. The lowest sales estimate is $66.50 million and the highest is $71.10 million. Health Insurance Innovations reported sales of $61.78 million in the same quarter last year, which would suggest a positive year over year growth rate of 11.9%. The company is expected to announce its next quarterly earnings report on Wednesday, August 1st. 24/7 Wall St.

24/7 Wall St.